We built a new and secure way to share your data online.

What is ConnectID?

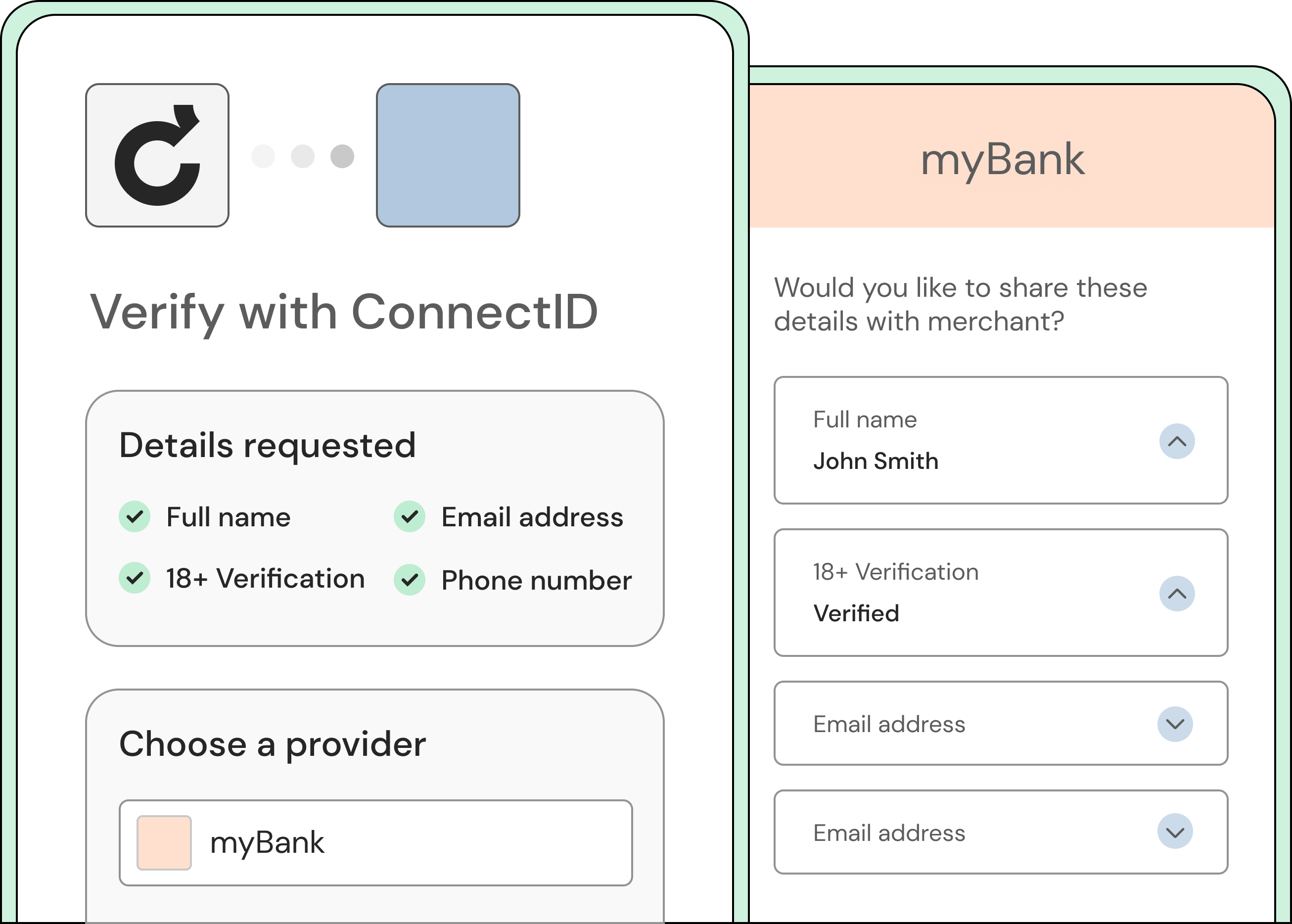

ConnectID lets you verify who you are using information stored with an organisation you already trust, like your bank.

No more selfies, and awkward document scans. ConnectID helps stop the transfer of unnecessary personal information between users and merchants. Now users have agency and can choose the specific details they share as well as the trusted source that already holds that information.

Additionally, since ConnectID doesn't see or store any data itself, it further enhances privacy and security in the process.

How does it work?

1

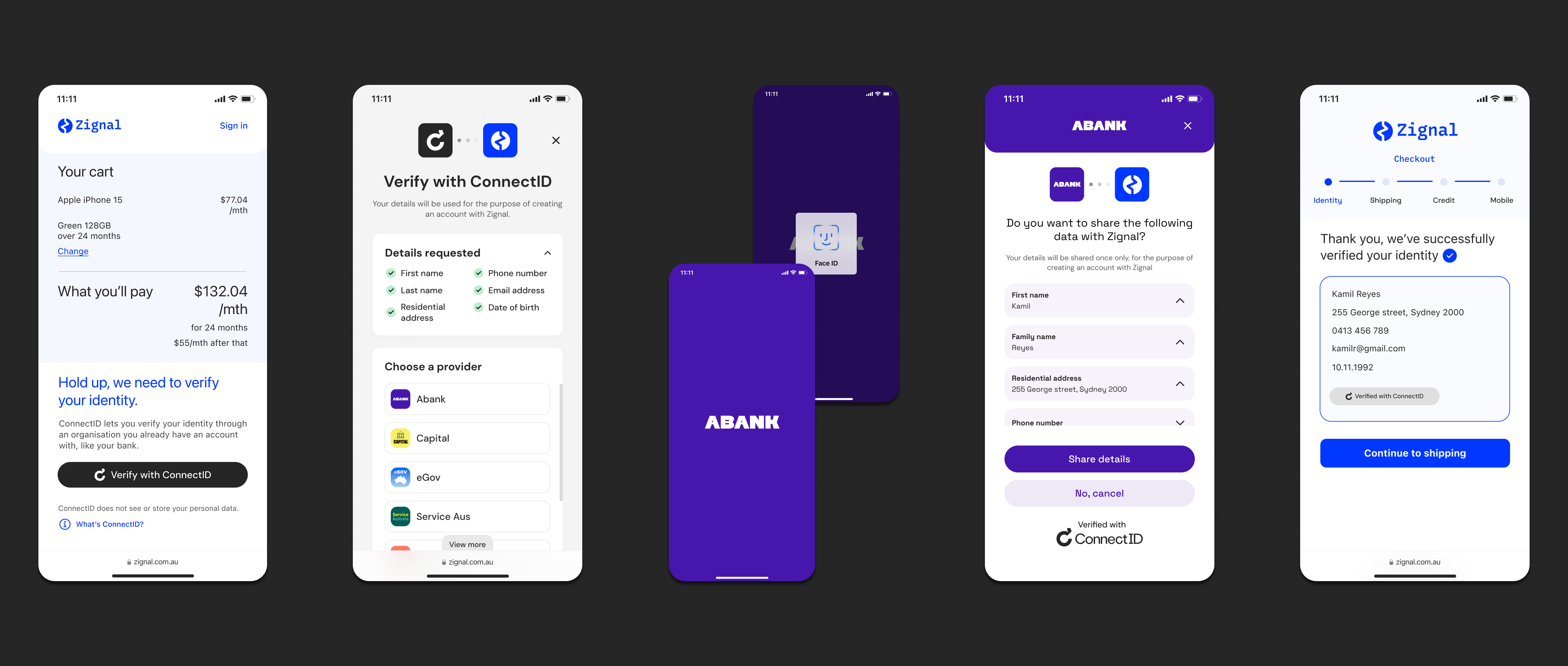

User is asked to verify their identity, and chooses ConnectID

Use cases vary from signing up to a new service, receiving insurance claims, and authorising your identity. Users have the power to decide how they want to share their details online.

2

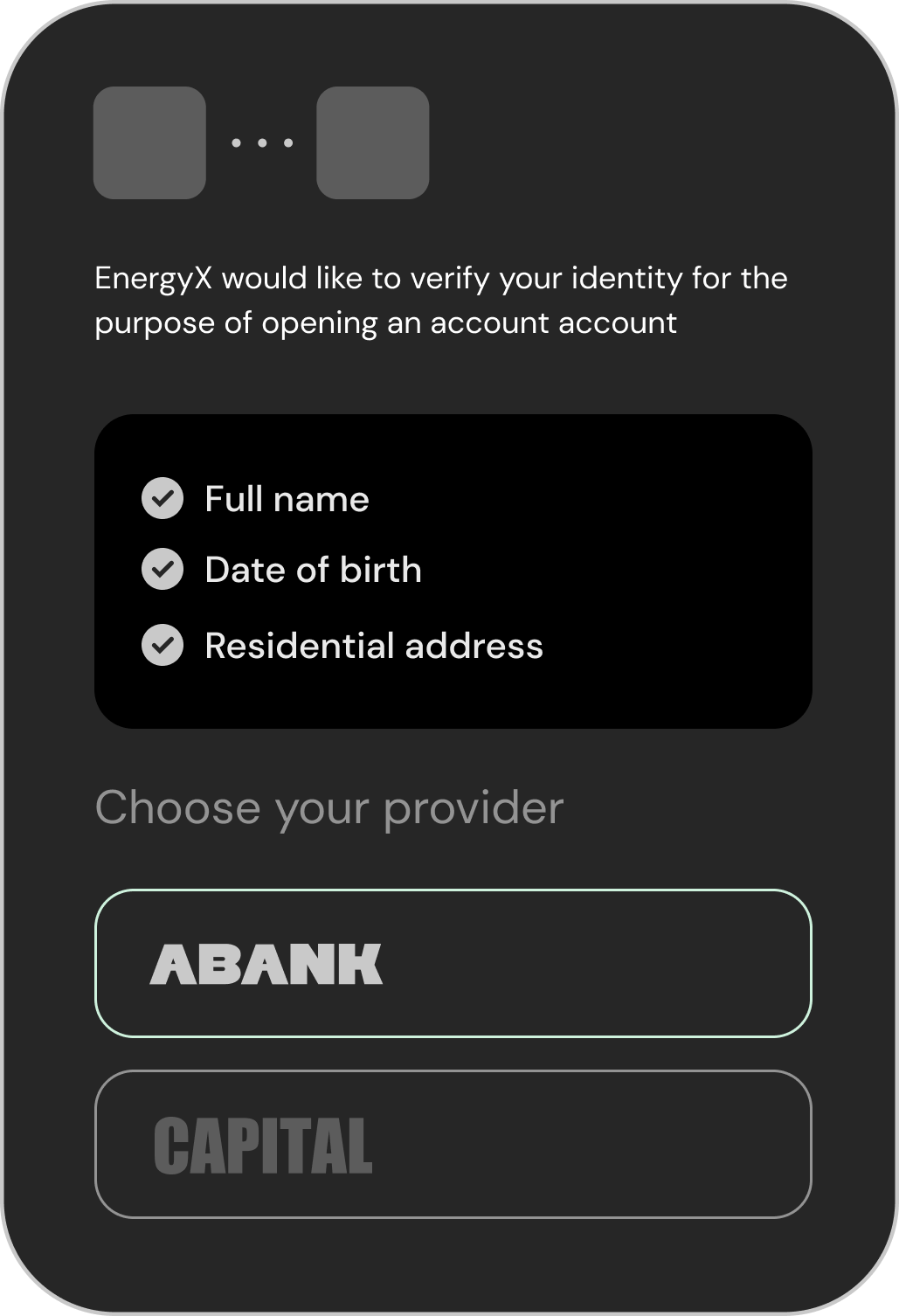

Choose an identity provider

In an SDK provided to merchants, the user is presented with a list of banks and government bodies that have signed up to become identity providers with ConnectID. These organisations already hold data you shared and verified with them, making the need to re-share data obsolete. This screen also contains the details an RP is asking for, giving the user full transparency and the choice to cancel the transaction.

3

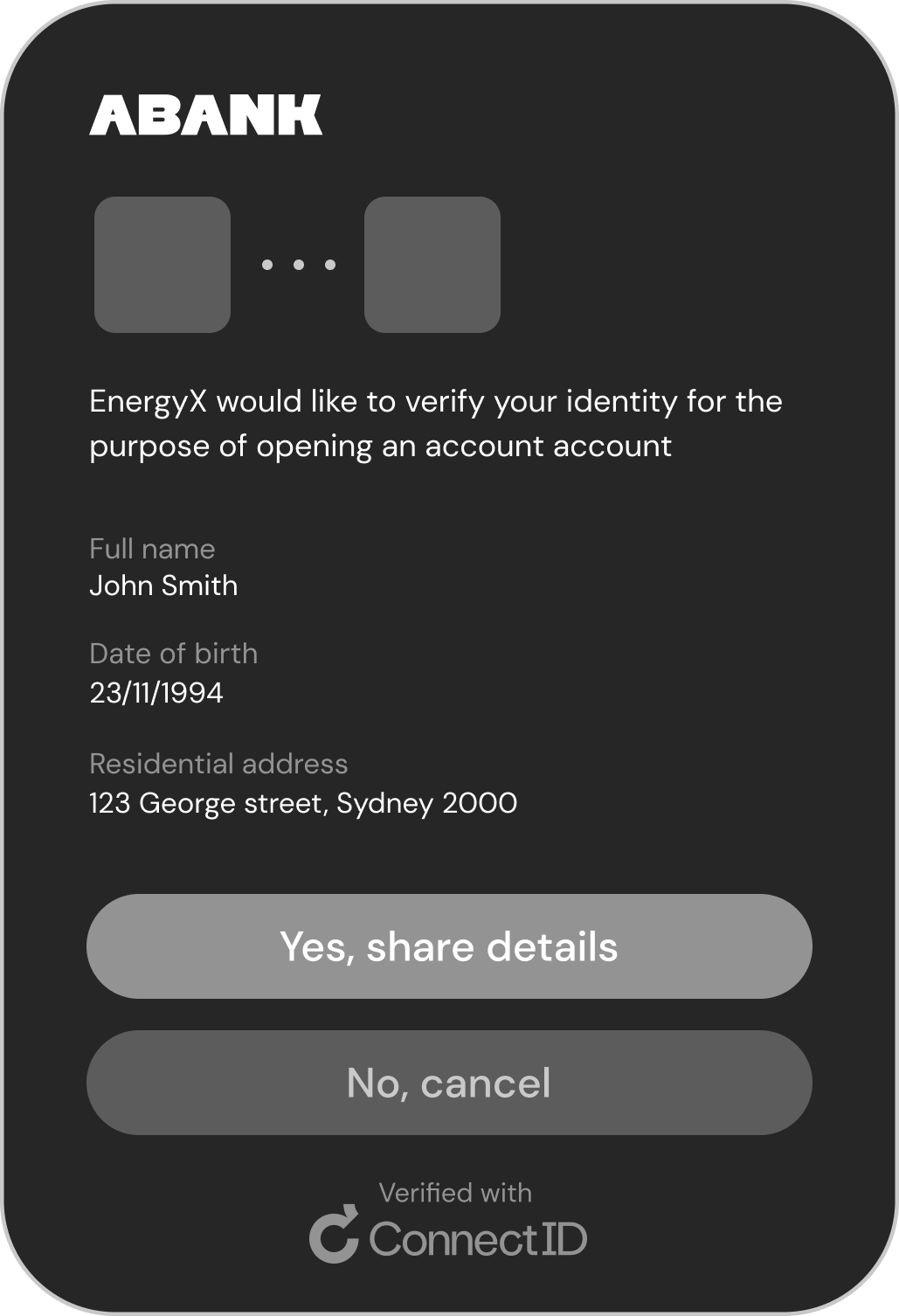

Provide consent and review details

Every Identity Provider has a consent screen. This screen reviews the information that’s about to be shared, and explains the reason for sharing. At this stage the user is able to cancel the transaction, or edit their details with the Identity Provider if needed.

4

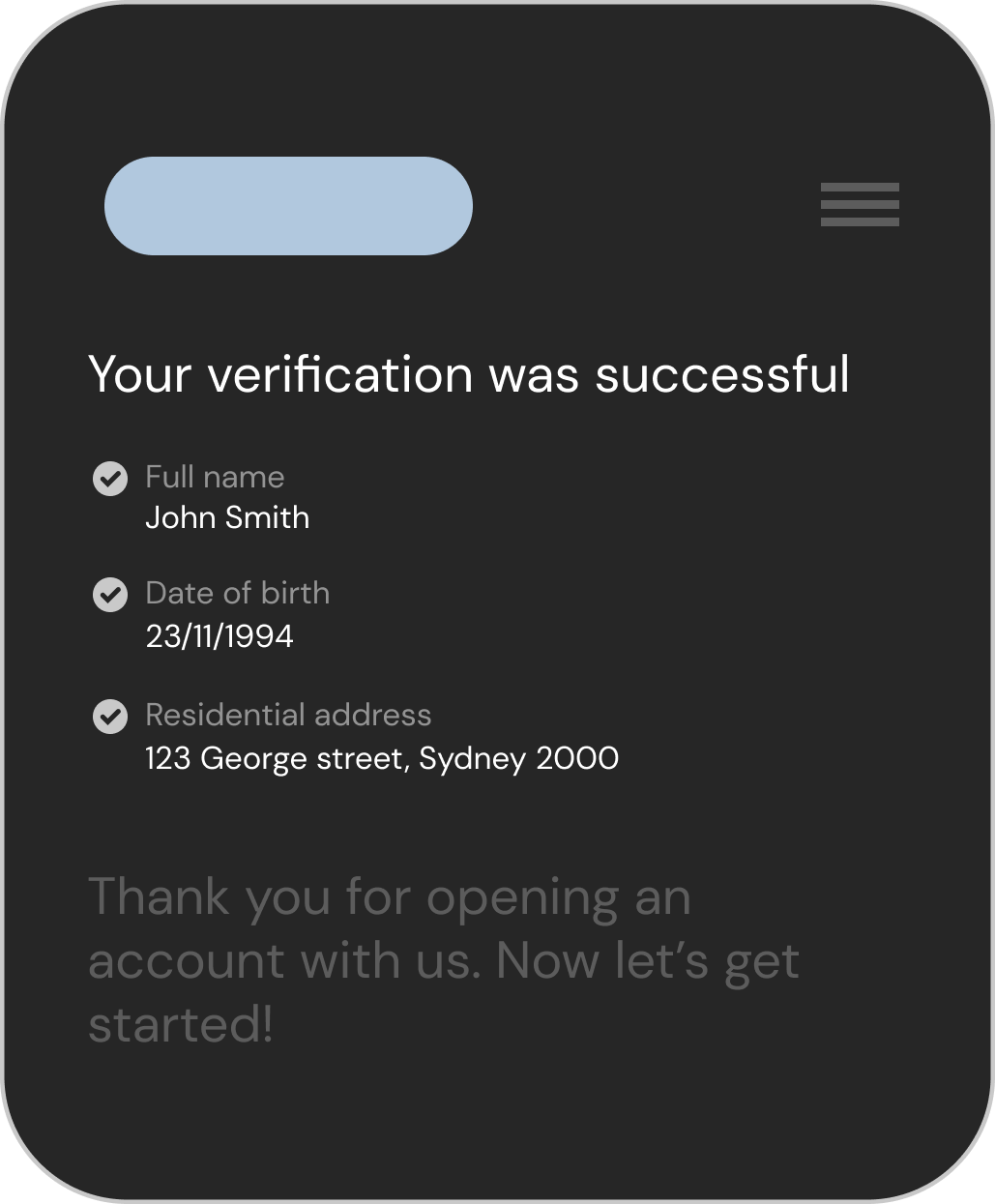

Final confirmation

This screen appears on the merchant’s page, once the verification is successful. This is final confirmation for the user of the success state and the details that were shared.

User research

Methodology

Tools

My team

Interview and a task

5 people

1hr per participant

Askable (recruitment)

Lookback (interviews)

Figjam (notetaking)

Figma (prototyping)

Zeenia Kaur - lead product designer for Beem

Jean Kim - product designer for Beem

Why?

My responsibilities:

This round of research was done pre-launch, in order to gauge perception of ConnectID when interacted with for the first time, and to assess usability. We were also interested in personal views and experiences regarding data privacy and security.

We presented our findings in a workshop to our current identity providers - three major Australian banks. It provided them with insights into how their customers might perceive ConnectID, and encouraged a sense of collaboration.

This research also helped inform the first release of ConnectID’s UX standards, in which I detail brand implementation and requirements for both identity providers and participating merchants.

1. Gathering requirements for research from internal stakeholders

2. Setting objectives for the research

3. Setting our recruitment criteria and recruiting process

4. Methodology

5. Creating a discussion guide

6. Setting up the tools (Lookback, Figjam for note taking, Askable credits)

7. Guiding internal stakeholders through the process (setting up a slack channel, schedule debrief meetings after every session to catch the critical points of interviews)

8. Interviewing and note taking

9. Synthesis

10. Presentation to stakeholders

11. First version of UX guidelines

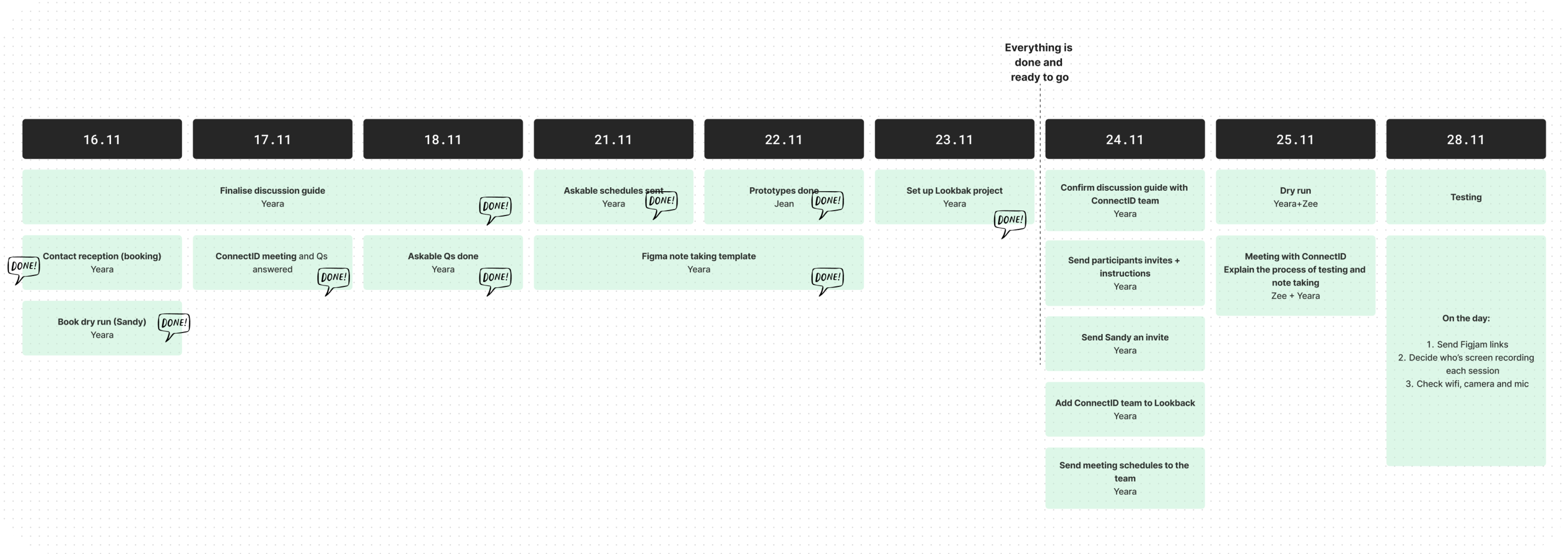

Process

1. Gathering requirements and setting objectives

It was important for us to engage the entire team in ConnectID before setting objectives. We wanted to gain perspective from the sales team that deals with merchants on a daily basis, with marketing to hear about brand perception and of course the product team. We wanted to know their pain points, usability questions and specific topics to clarify with users.

We came up with these objectives:

1

2

3

Learn what consumers consider to be ‘personal information’.

Uncover sentiments around data storing by companies - when is it necessary & when not.

Identify what consumers want to know about ConnectID and where they’ll go to find out.

4

5

6

Determine whether ConnectID is valuable to consumers, and why.

Understand perception of ConnectID as a service.

How will customers use ConnectID? How does the experience feel?

Screenshot from our Figma file in preperation for research

2. Hypothesis and assumptions

As product designers, we had our own concerns and assumption about the flow we were testing. Our hypothesis was:

People are concerned about data sharing/storing.

They might prefer to use ConnectID to verify their identity, and fill in their details.

And these were assumptions we made:

1. Consumers need more information about ConnectID to build trust.

For this reason we added a link to ConnectID’s pilot website. We wanted to see if the website marketing created is easy enough for users to understand.

2. ‘Verify with ConnectID’ button won’t be clicked unless there’s more information around it.

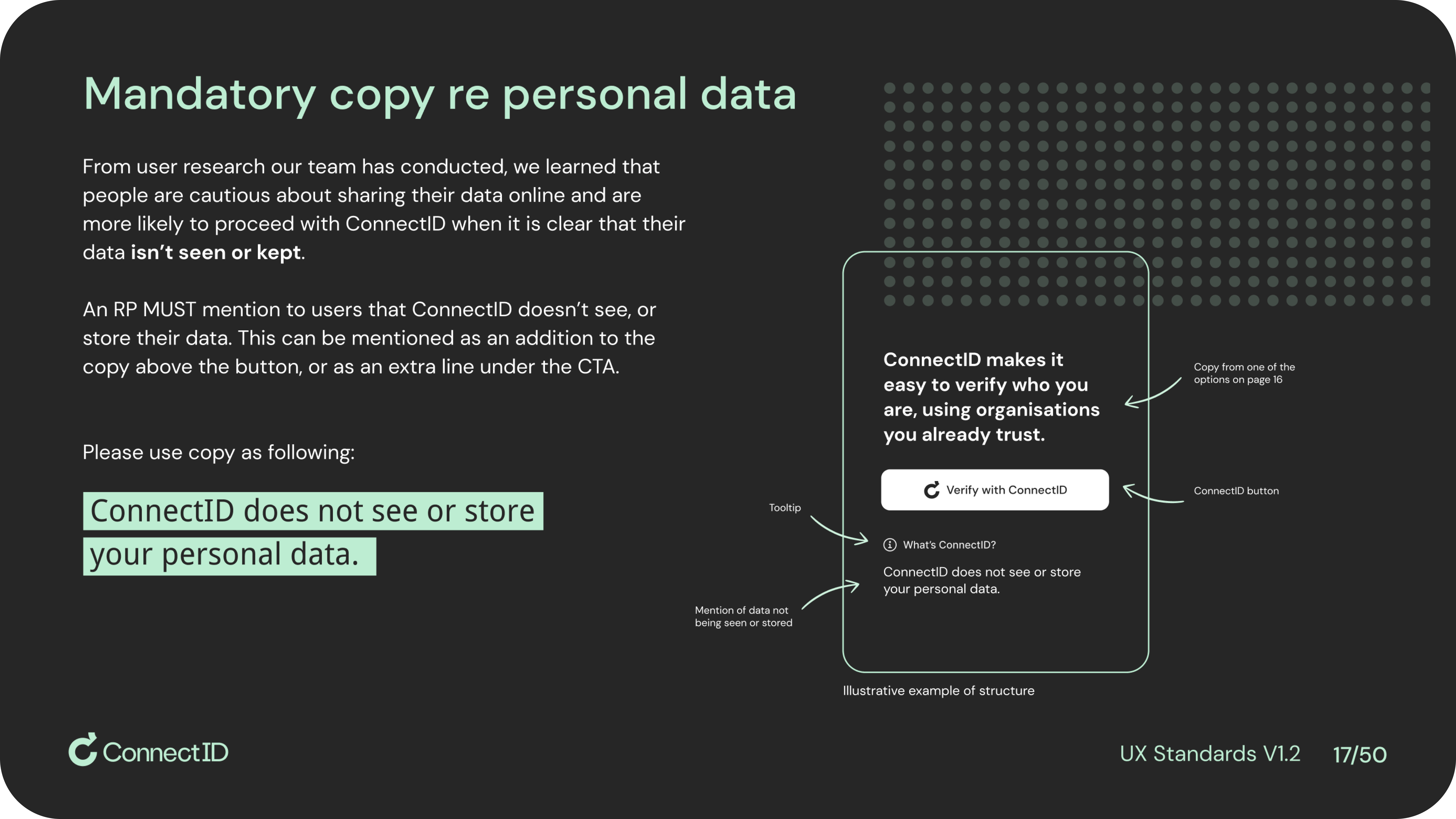

A tooltip with information about the brand was added to the design. We wanted to find out if it’s helpful and if people engage with it.

3. Consumers might struggle to understand who stores their data when using ConnectID.

We felt like it might not be obvious to users that data is NOT being stored by ConnectID. ConnectID is a ‘funnel’ that transfers information between an identity provider and merchant. It was important for us to ask at the end of the task ‘who stores your data now?’. This would inform new design decisions and UX guidelines implementation.

4. ‘Verify with ConnectID’ button stands out so consumers will notice it immediately.

In the prototype, we deliberately presented ConnectID as the first option of self verification, before the form. We assumed that once they see how laborious the form is, they would choose ConnectID instead.

5. Consumers will recognise at least one of the identity provider logos as they’re well-known national brands. This will help build trust.

We assumed having trust-worthy brands linked to the CTA will encourage people to feel safe to continue with the task.

6. Consumers will understand what happens next once they choose a provider.

One of the main questions we had was - is the flow we built intuitive? will people know what’s about to happen and trust the product, or will they need prompts and extra reassurance?

7. Consumers will resonate with ConnectID’s value prop and prefer to use this over the RP’s manual entry flow.

We assumed ConnectID’s value is very obvious, especially when presented next to a long manual option. Therefore, consumers will choose ConnectID to verify their details, instead of a manual process.

8. Consumers will understand they can’t edit their details after verifying with ConnectID.

Due to the nature of the flow, where an identity provider verifies your existing details on record, you can’t edit the details that were verified. To edit the details you have to get in touch with your identity provider (in this case your bank). We assumed that through design cues, consumers will understand that the process is in a final state and they won’t try to click into it to edit.

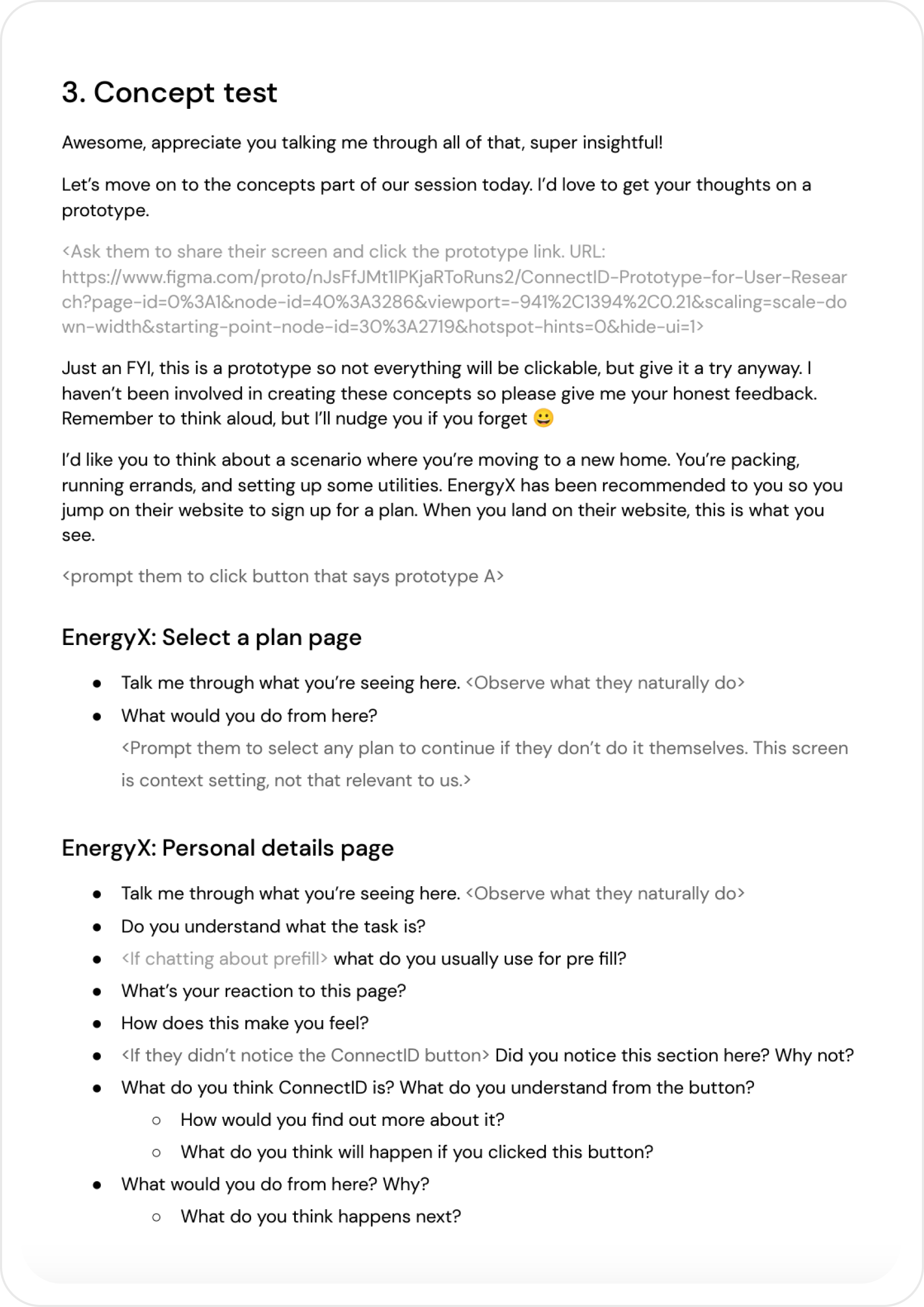

3. Methodology

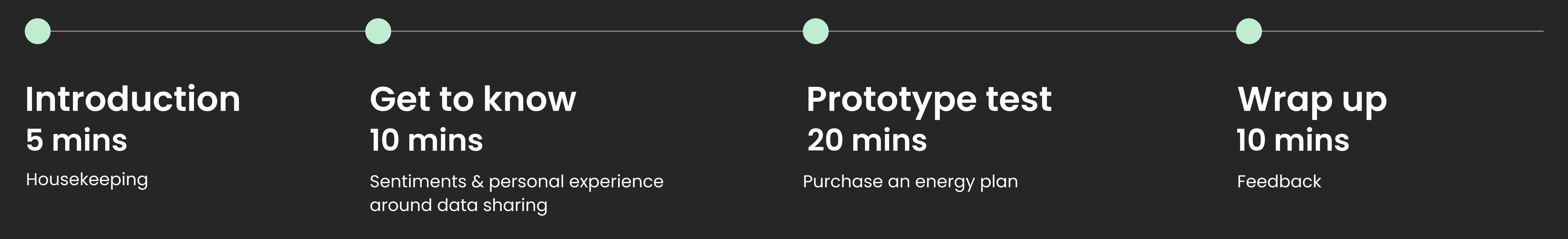

Qualitative interview with task

Due to the type of insights we were after and the objectives we set, our methodology of choice was qualitative research. We wanted to watch natural use of the product as well as learn about personal experience with data sharing and scams. Our 45 mins interview with each participant included an introduction, questions about personal experience with data sharing, concept testing and wrap up section where we asked them how they felt about going through the flow.

The tool we used for interviews was Lookback. It allowed us to share screens, save the video and have internal viewers that were hidden from the participant.

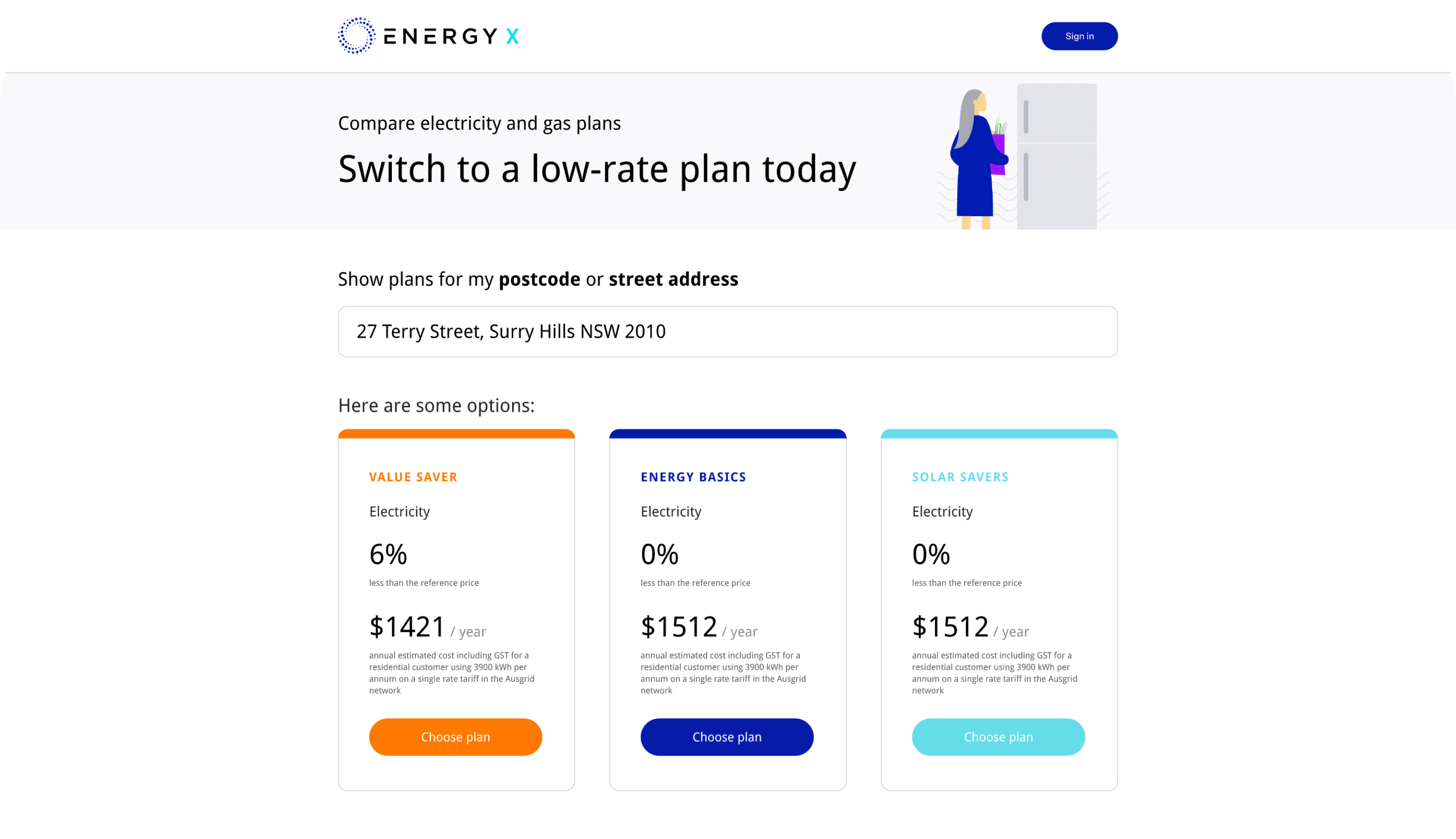

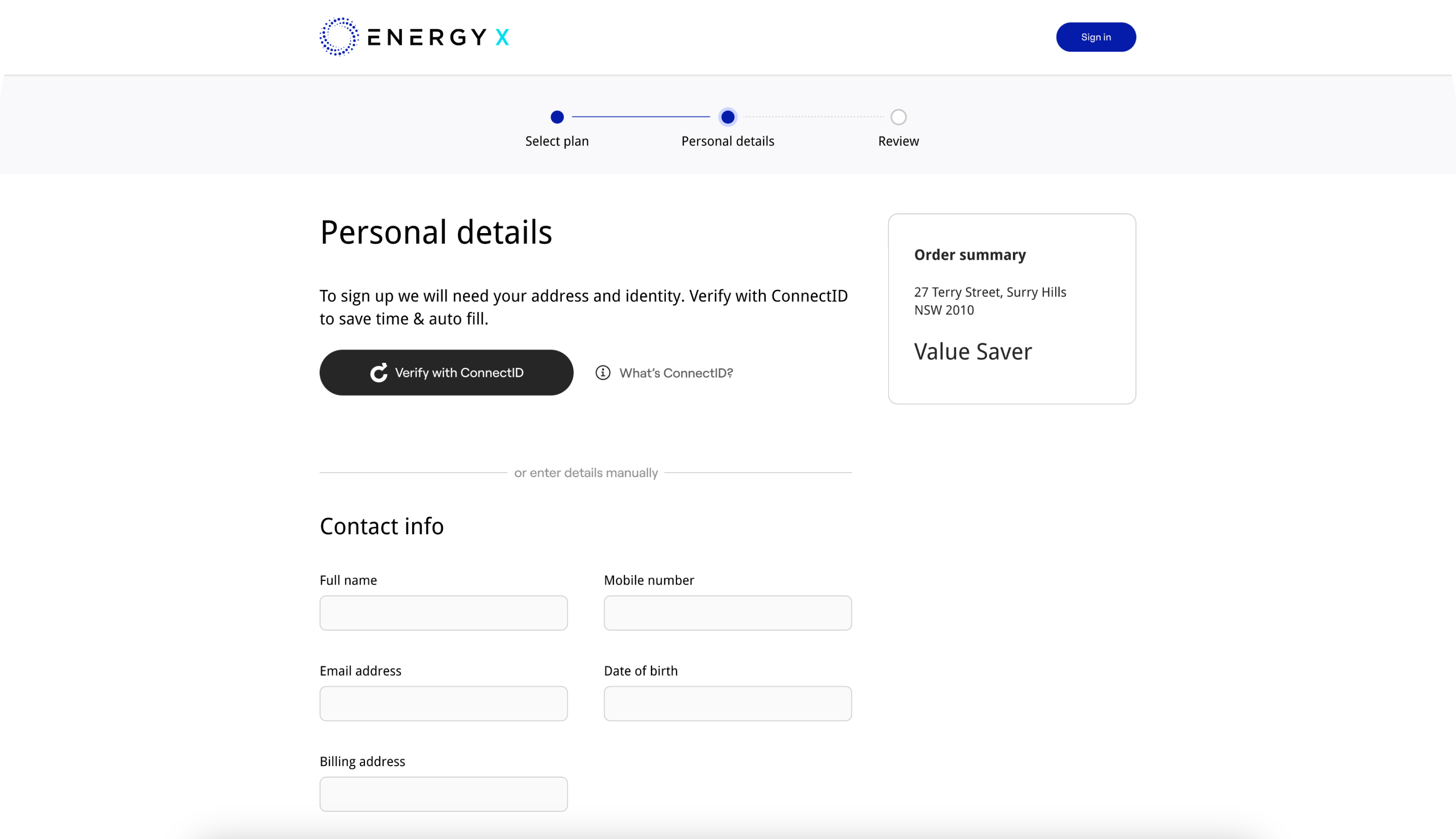

Task

We wanted to watch people purchasing an energy plan online. We were curious to see how participants approached filling in a significant amount of personal details - do they feel like it’s a hassle? do they have an issue providing certain details?

They had an option to fill details manually, or through ConnectID.

The task will help us:

- Determine if participants use ConnectID, or prefer to fill in their details manually.

- Understand which identity providers participants choose and trust.

- View sentiments around filling personal information and sharing data.

- Learn if participants understand ConnectID’s value proposition.

- Observe if the current user flow is confusing/easy to use.

The flow had to emulate a real life scenario, so we didn’t tell participants what ConnectID is in advance, nor where to click on the page.

Interview / discussion guide

Session structure

45 mins, 5 participants

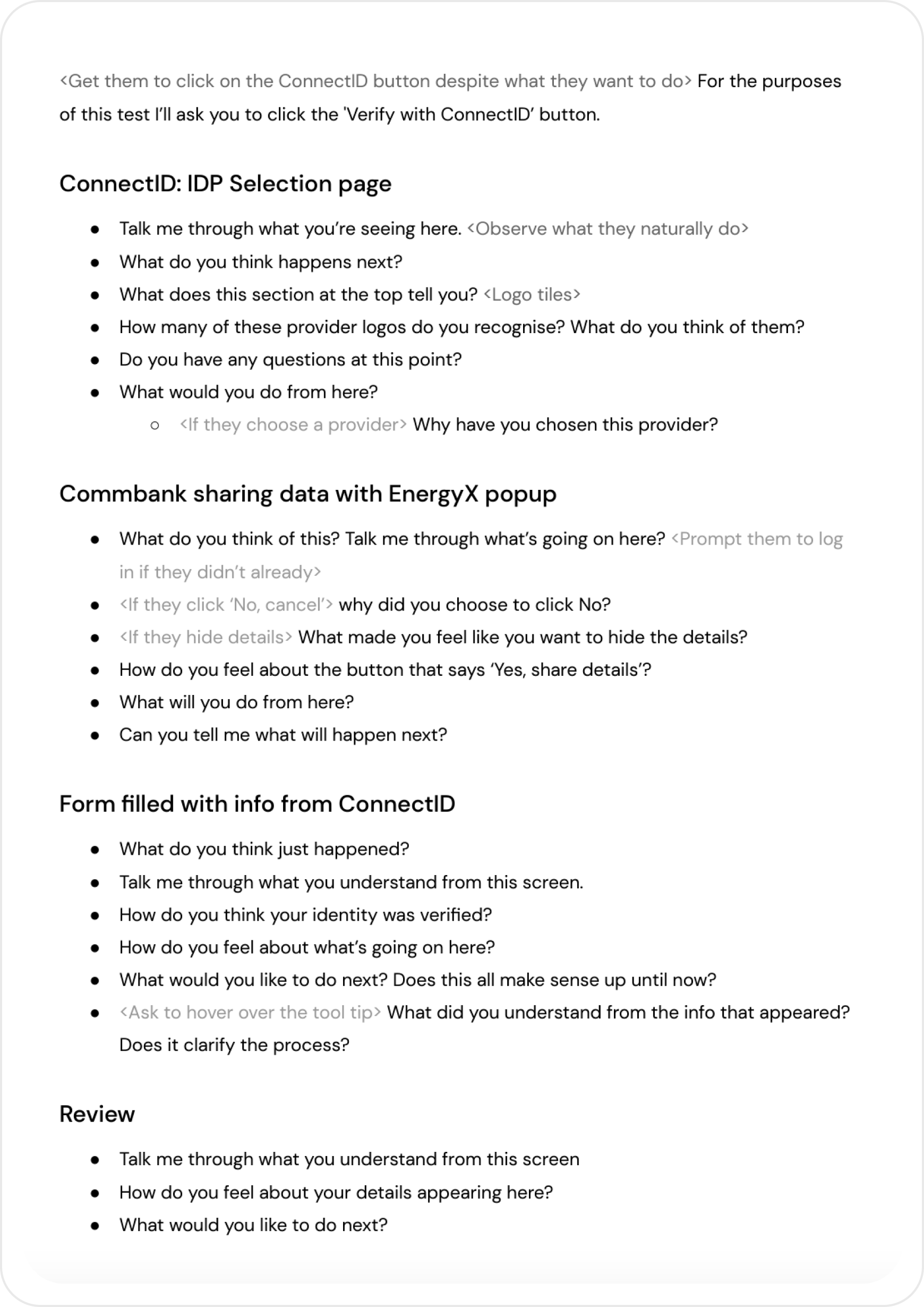

Discussion guide

While conducting the interviews, we followed a discussion guide we wrote in advance.

Here are the main questions and conversation pieces we presented to participants in each stage:

Introduction

After explaining the structure of the session, we wanted our participants to feel comfortable and be honest with us. We let them know the session can stop at any time, they’re not being put to the test and that we had nothing to do with the design or concept - so they can feel free to express their opinions.

Discussion guide statements:

‘Everything you say is in confidence and there’s no right or wrong answers.’

’We’re testing the concepts and not yourself.’

’Remember, you can leave or stop at any time and please let me know if you need me to repeat anything, want more information, or do not want to discuss a topic.’

Next we wanted to understand how the participant interacts with their bank, as it is crucial in the ConnectID flow that users have a banking app, or bank online via browser. We were also interested in the sign up process. Was it a painful or easy experience? This also sparked conversation about why they chose a specific bank or in some cases - multiple institutions.

Discussion guide questions:

‘How long have you been banking with <bank name>?’

’Do you recall the process of signing up with <bank name>?’

‘(If it’s been too long) Are there other banks you recently signed up for?’

‘How do you manage your online banking? App? desktop?’

Last part of this section was dedicated to sentiments around sharing personal information online. We were interested to find out what do people even consider to be personal information, where they keep important information and documents and experience with data breaches. Answers to this section helped us map out what people feel comfortable giving online, and if a product like ConnectID would have value in their eyes. The main sentiments we were trying to learn about here were trust and control.

Discussion guide questions:

‘How often do you find yourself filling out personal information online? On apps or websites or forms, etc.?’

’What would you consider to be ‘personal information’? What kind of information do you normally fill out about yourself??’

‘Do you feel like you’re in control of your personal data? Why / why not?’

‘Where do you normally keep important information & documents about yourself?’

‘What makes you trust companies with your sensitive information? Why?’

‘Have you heard of the recent Optus & Medibank data breach? Were you impacted by this? How does this make you feel?’

‘Did your behavior / lifestyle change after these incidents? How?’

Prototype task

As mentioned above, we wanted to watch natural use of ConnectID, so we didn’t tell participants about the brand nor asked them to click on the CTA. We got to see their genuine reaction when having to provide personal details online and interest in the ConnectID option.

The discussion guide mainly had open guiding questions, like - what are you seeing here, what would you like to do next, what would happen if you clicked here, do you understand the task, etc...

Some questions were specific to certain actions we wanted to learn more about, like:

‘What do you think ConnectID is? What do you understand from the button? How would you find out more about it? What do you think will happen if you clicked this button?’

’How many of these provider logos do you recognise? What do you think of them? Why did you choose that specific one?’ (referring to banks that are identity providers)

‘How do you think your identity was verified?’

Next, we asked participants to go over the ConnectID website. We wanted to find out if the website helped clarify what ConnectID is and how it works. A tooltip that was added near the ConnectID CTA had a link to the website.

Discussion guide questions:

‘After browsing this page, what does ConnectID mean to you now?’

’Can you explain the concept to me or how it works?’

‘What information is missing here for you? What else do you feel like you’d like to know?’

Wrap up

In this section, we asked general questions about the brand and concept in order to learn how participants felt about going through the flow and their understanding of the product.

Discussion guide questions:

‘What words would you use to describe the experience you’ve had using it?’

’How does this compare to your current experience?’

‘Is this something of value to you? Why or why not?’

‘Throughout this concept you looked at, if you can remember, what data of yours was being shared? When did this happen and how?’

‘Who do you think has your data now? Do you recall signing up with CID? How would it make you feel if I said you didn’t have to sign up?’

‘Did you recall signing up to ConnectID?’

‘What if I said CID doesn’t store your data? How would you feel?’

‘Can you explain to me what ConnectID is?’

4. Recruitment

We had internal capacity to engage 5 people in interviews.

We wanted these people to be quite different from one another, so we can gage an audience of different ages, financial circumstances and life experience. We were especially interested to see how stage of life influences people’s willingness to share information online or use connectid (for example - people who pay bills, who have bank accounts, have taken on a mortgage, pay rent, etc...).

Askable was our tool of choice for recruitment. We created intial screening questions to engage the correct people.

Askable quiz drafted in Figma

Our criteria

Australian citizen or PR

We wanted participants with at least three forms of ID, that have had to go through the process of verifying their identity in the past.

Over the age of 18, under 65

Participants had to have experience with paying rent, signing up to utility services, open bank accounts, etc...

Excluded people in identity, design, product and software

We didn’t anyone with a bias or expertise in the field.

Account with bank or government services

This again answers the need to speak to people who have gone through a complex identification process.

What banks have you used online banking with?

We had a preference for CBA customers, as they were our main stakeholder at the time. We also wanted participants that have an active bank account they engage with on a regular basis.

Have you ever signed up and used a utility provider?

This question helped us create customer segments. Our theory was that participants that have more duties within their household would be more inclined to use a product like ConnectID.

Where do you live? (state, suburb, post code)

We were aiming for a combination or rural and metro, to learn if perceptions are different.

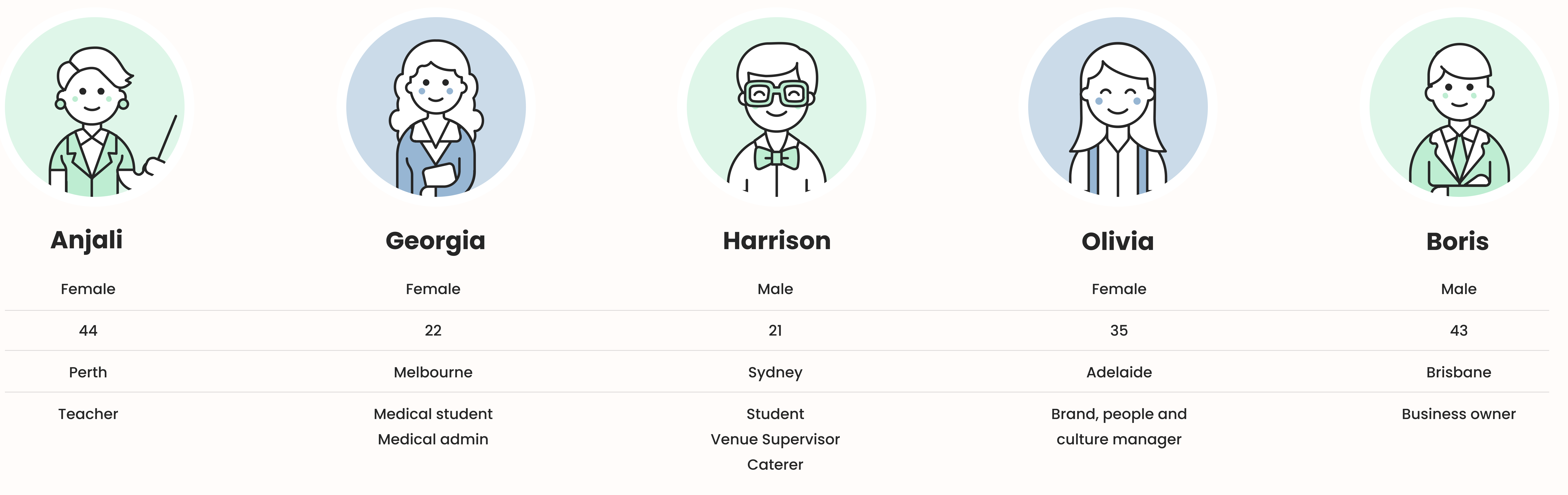

Participants

We selected 5 participants, with ages ranging from 21-44. Each was in a different stage of life and circumstances.

A broad range was our preference, as we wanted to learn what were the features that made participants interested in ConnectID versus the ones that wouldn’t find value in the product.

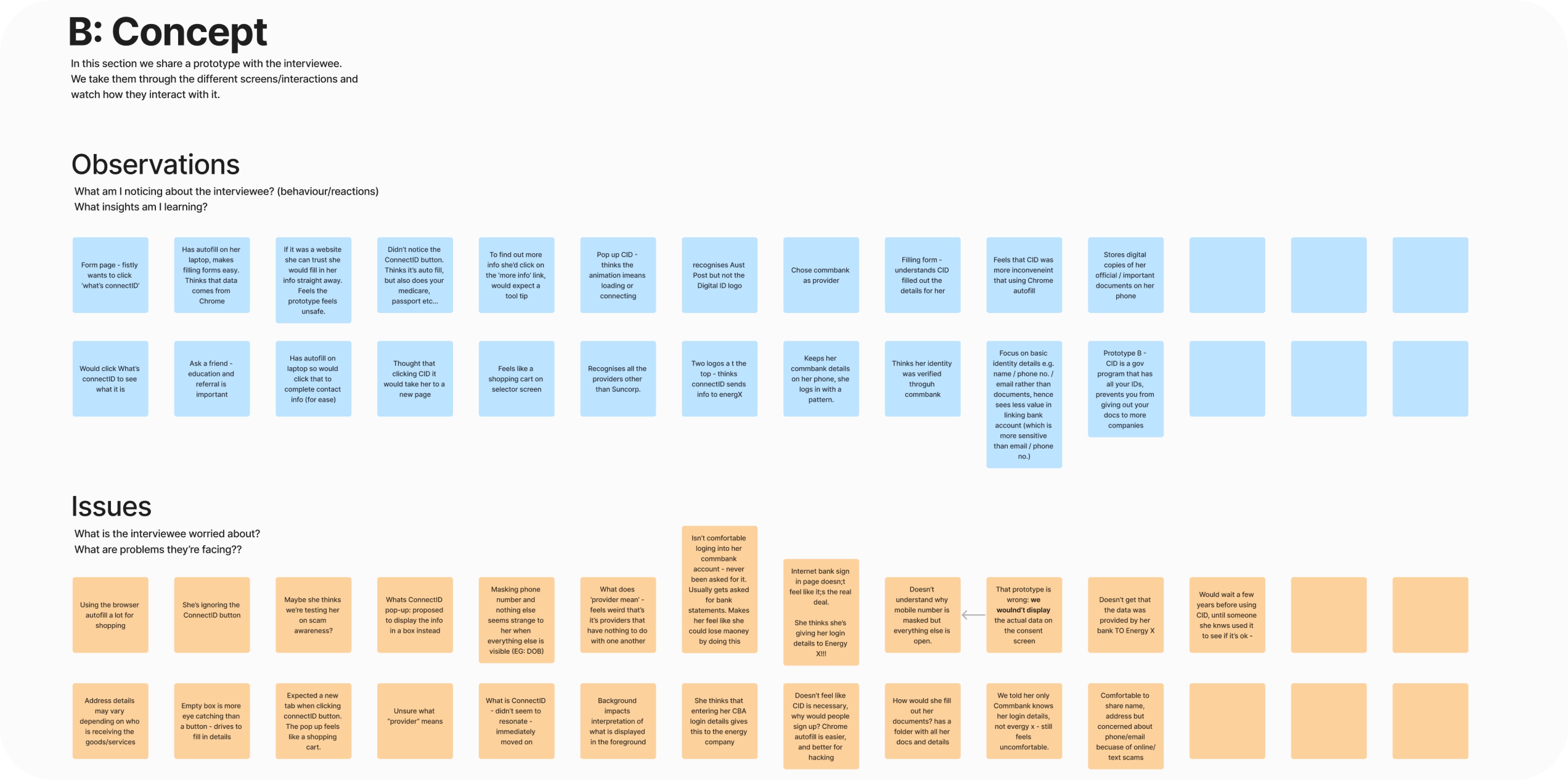

4. Synthesis

To make the synth process a bit easier, we set up meetings with all our internal viewers and note takers after every session.

Each meeting was 15 minutes long, and we discussed our main conclusions from the sessions. I found this to be a great way to wind down from the interview, receive feedback for myself, capture insights and different perspectives.

After we finished the sessions, myself, Zee and Jean got together to look at our findings against our objectives and assumptions. We extracted themes and patterns we found within participants responses, as well as observations that stood out from the rule.

We then prepared a deck that was to be shared with our stakeholders in a workshop, in a way we can receive feedback and start conversations.

Note taking during an interview

Themes we compiled during our post-interview meetings

Main findings

None of the participants felt like they’re in control of their personal data nowadays.

"

What we thought was safe is no longer safe.

Anjali

44, teacher

Most of the participants we spoke to were impacted by the Optus and Medibank breaches. Some of them were also victims to other scams that took advantage of their data online. Despite expressing fear and frustration, participants found enough value in giving personal details (they feel like they have no choice in today’s digital world) to some services, like government and banks.

"

Even the biggest companies do it {sell his personal info}

Harrison

21, student and caterer

All participants were more inclined to fill their details in manually, rather than use ConnectID.

"

I don’t understand why I’d do this. I’d rather just fill manually.

Harrison

21, student and caterer

Most of the participants skipped the CID button/section.

Their initial instict was to fill in their details manually, and their attention had to be bought back to the section.

Some also mentioned that since the form looks fairly easy to fill, they wouldnt need ‘auto fill’. Most participants also did not notice that a driver’s lisence verification is required in the form.

All participants perceived ConnectID to be an auto-fill tool.

"

Why would people sign up?

Chrome auto-fill is easier

Georgia

22, medical student

Participants we spoke with thought CID is an auto-fill tool. They made comments referring to Google auto-fill and the fact that their info is already going to be populated.

ConnectID website doesn’t reflect the proposition accurately.

"

Having an AusPost ID, I reckon it’s about the same

Anjali

44, teacher

After going through the concept, we shared the CID homepage with the participants. We asked them to read through it and explain to us what ConnectID is.

Most of them understood the concept of a third party that transfers their info and verifies their IDs, but also concluded that this is a service that requires signing up with, or an app to be downloaded.

*Quotes captured while participants viewed the CID website.

"

It’s a government based program that has all your IDs

Georgia

22, medical student

All participants assumed ConnectID stores their data through the process.

"

I think there’s three parties that have the data now {refers to CBA, ConnectID and EnergyX}

Boris

43, business owner

When asked ‘who now holds your data?’ (after completing concept task), all participants included ConnectID in their reply.

When told there isn’t a signup process and data wasn’t stored, they had a positive response.

"

That’s where I’m not 100% clear, if ConnectID are holding on to that data. Without it saying that it’s not, I do assume that

Olivia

35, Brand, people &

culture manager

Participants find government and their banks to be trustworthy.

"

They’re all trustworthy ones. Banks, particularly MyGov. The fact that it’s there adds to the confidence

Olivia

35, Brand, people &

culture manager

When asked how they feel about the providers, participants said they feel they can trust them - since they are major banks or government entities.

The trust comes from familiarity, using services in the past that had a positive outcome. Some participants mentioned they believe there’s a big IT network for these entities and they’re very safe to engage with.

Overall, the ConnectID user experience was well received by all participants.

"

The steps themselves are simple and quite intuitive

Georgia

22, medical sudent

When asked how they feel about the experience of the concept, participants said usability was simple and easy.

No major usability issues with the process itself. It’s not understanding the value of ConnectID that would prevent them from moving forward, not the UX.

*Tested with a happy path on a desktop experience.

"

The experience is pretty straight forward

Boris

43, business owner

"

Something like this would have made the overwhelming process much easier with a few key steps

Olivia

35, Brand, people &

culture manager

ConnectID logo ‘communicating’ with the seller logo was useful to explain connection and transfer.

"

I recognise ConnectID logo {referring to the first screen}, I assume that they’re talking to each other {referring to EnergyX logo}

Olivia

35, Brand, people &

culture manager

Most participants understood the meaning behind the three dots animation between the logos. Our research finds that it’s a succesful visual way of communicating that connection.

"

That one {ConnectID logo} is trying to engage with EnergyX... so ConnectID can verify your identity with EnergyX

Anjali

44, teacher

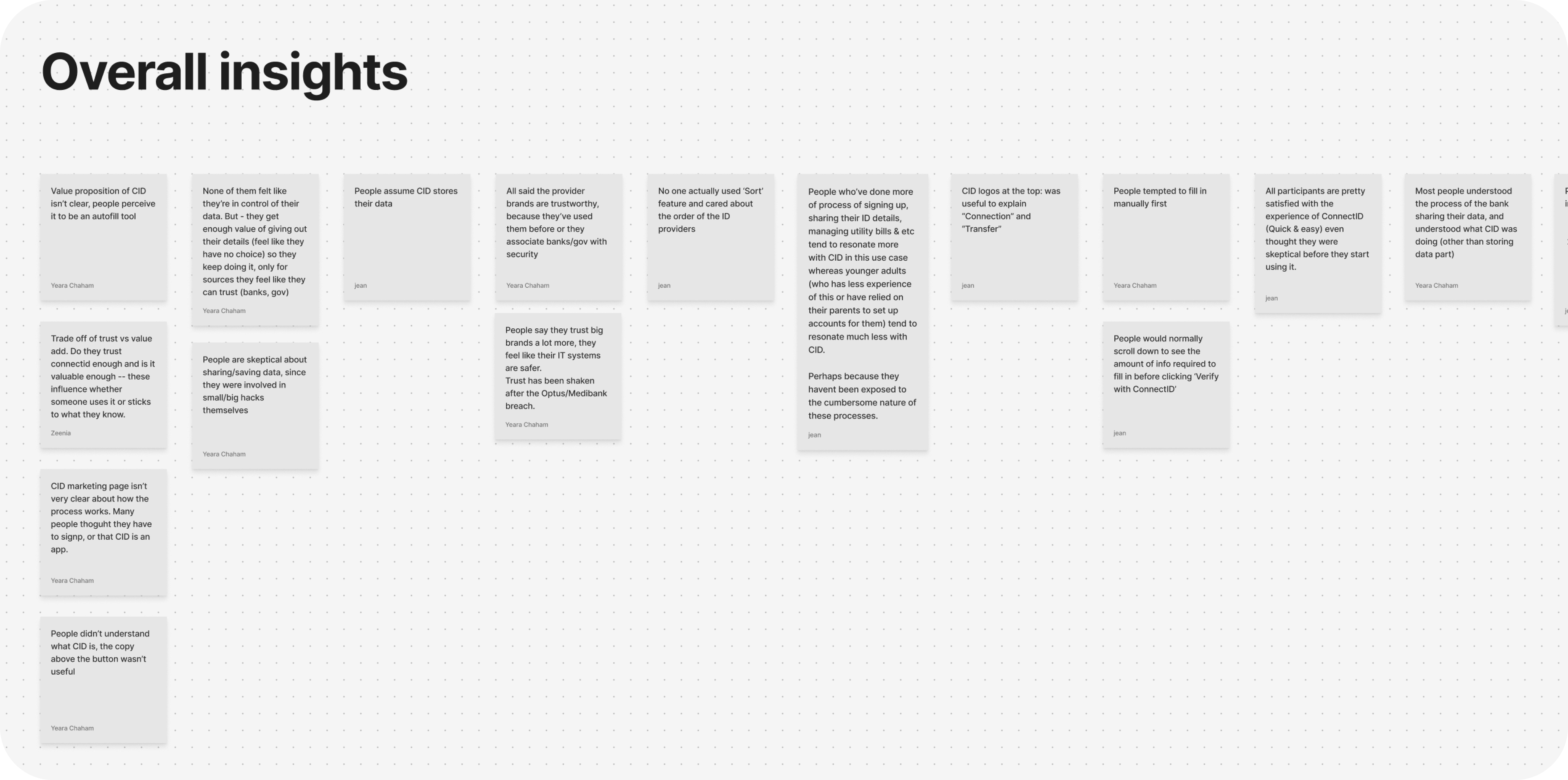

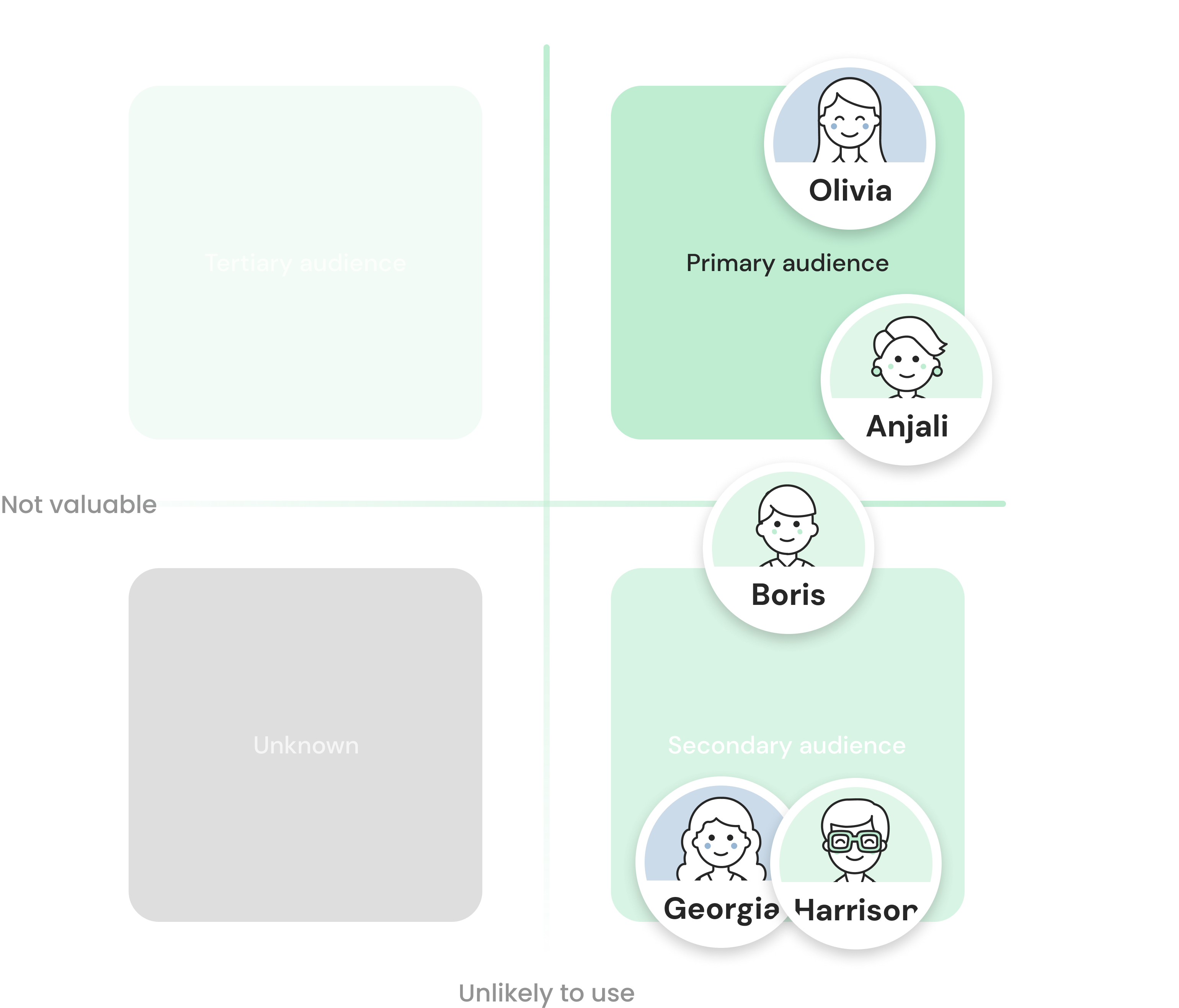

Post research insights

Customer segments

By engaging participants with a wide range of backgrounds, we were able to pin point the audience that would resonate with ConnectID’s value proposition the most.

Primary audience

Highly likely to find value in ConnectID and use it without too much guidance.

- They do their own research

- Willing to try new products

- Individuals with government issued documents, and bank accounts.

- Stage of life: live in their own place, take ownership of household admin.

Secondary audience

Need more of a reason and support to use the tool. Benefits have to be communicated clearly by ConnectID.

- Prefer to wait for someone else to tell them about a new product or feature

- Need to be pushed to do their own research

- Likely haven’t opened their own bank accounts - their parents did it for them when they were underaged.

- This group tends to skew younger, in an earlier stage of life. They’re likely living with their parents, or housemates.

Tertiary audience

Underaged or temporary visa holders.

This group wasn’t a part of the research, as our assumption was that this group doesn’t have enough government issued documents. The group could potentially benefit from using ConnectID, but these use cases will be explored in the future.

Takeaway

Participants with more experience in household & life admin tend to resonate with ConnectID.

Change through findings

These are the changes I’ve made in requirements and the product following our findings from research and discussion with stakeholders:

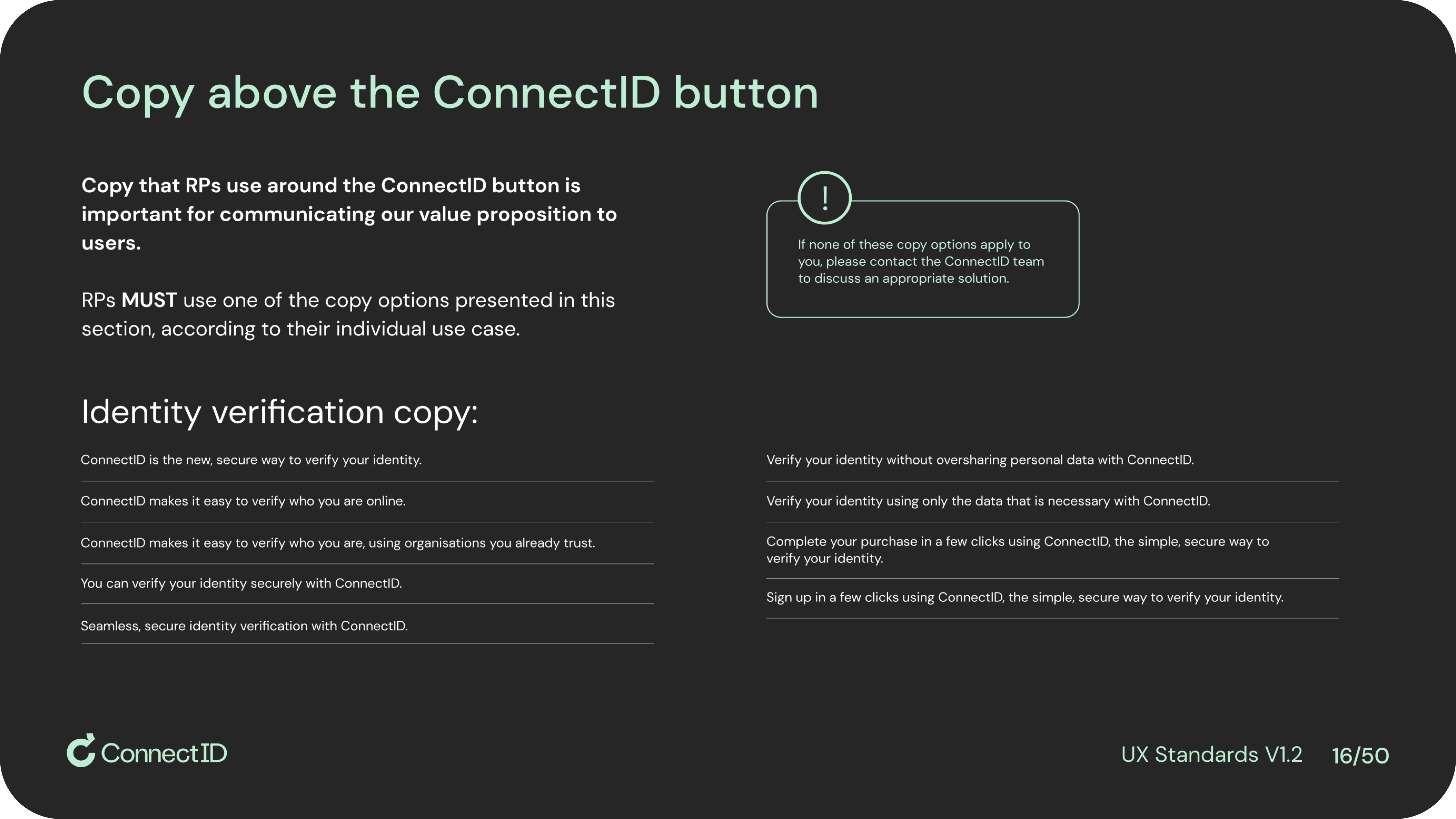

Standardise copy above the ConnectID button

Research made it clear that the copy surrounding the ConnectID CTA is crucial in understanding the product and value. The copy presented to participants had the term ‘auto-fill’, which proved to be detrimental for adoption and willingness to engage. I decided to add a requirement to the UX standards that copy above the button must be selected from a list of approved terms, and if RPs can’t find something that works for their use case, they can contact me or the ConnectID team for a discussion. This way we take control and standardise the way ConnectID is presented to users.

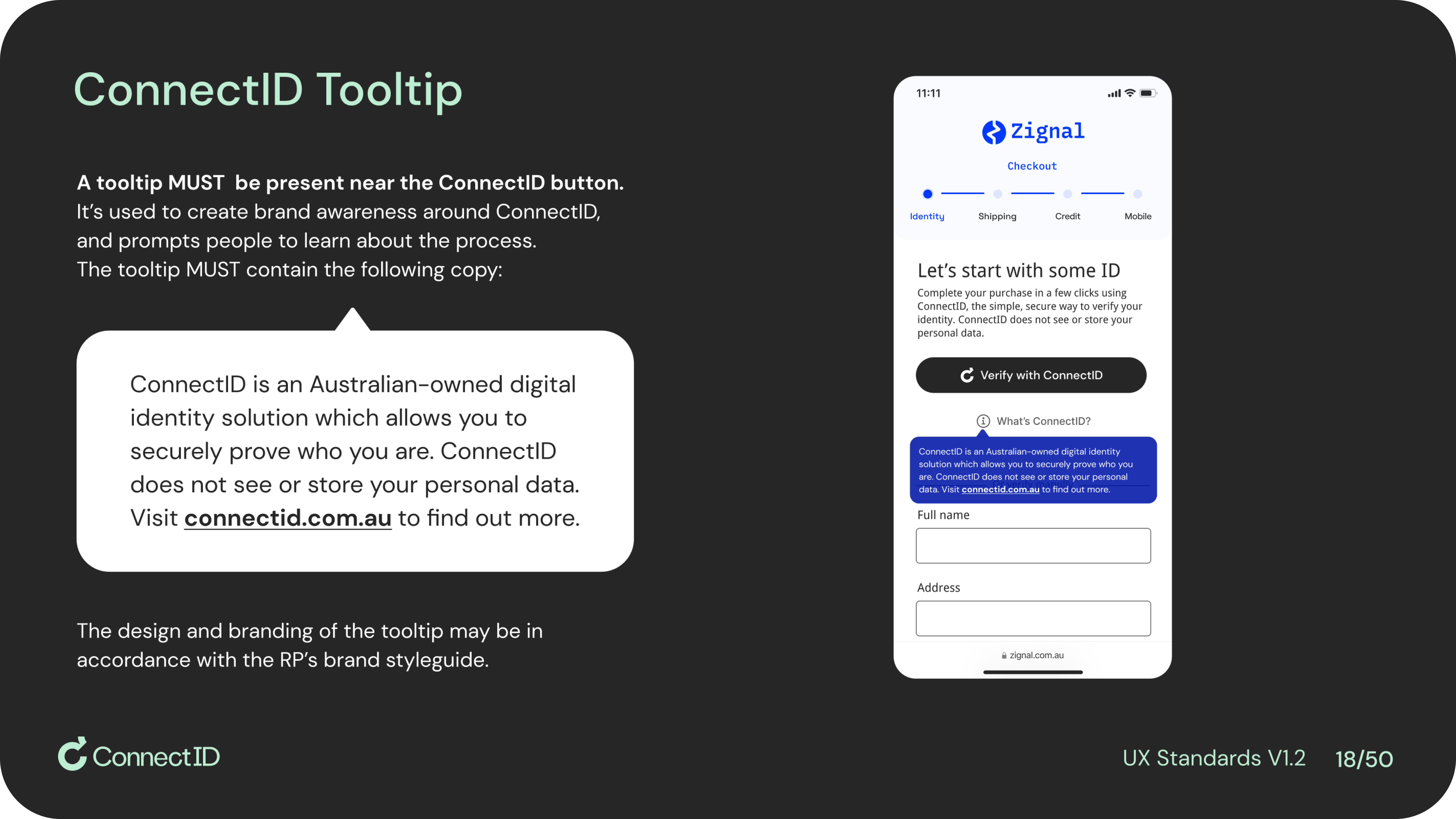

Data mention

Research taught me that participants weren’t sure who’s holding their data at the end of the process. As part of the UX standards, I added a requirement for RPs to add this sentence around the ConnectID CTA ‘ConnectID does not see or store your personal data’. This sentence also repeats on the IDP selector screen, where users are asked to choose an identity provider. This will help provide a sense of safety and control.

Tooltip

The tooltip we added to the prototype helped users to learn more about ConnectID and its offering. I decided to make the tooltip a requirement for RPs, with approved copy and a link to the ConnectID website.

Purpose statement

The reason for asking for a user’s data is stated on the IDP selector screen, as well as on the IDP consent screen. This is a common thread that creates consistency during the journey, that reassures users.

External link

A link was added near the CTA to the ConnectID website, to provide more information and confidence.

Website refinement

The website needed a clearer value proposition. The language was a bit vague and there wasn’t a clear explanation to how to product works. We also recommended a section of participating RPs and IDPs to be shown, to add credibility.

Marketing campaigns

We recommended the amplification of marketing campaigns in multiple channels, especially through our IDPs. We felt that the way the product is presented in the flow can do a lot of the ‘heavy lifting’, but ultimately users also need to have a good brand recognition.

Post-launch user research

A bigger round of user research a couple of months from launch should be done, after analyzing our data and recognising new pain points.

What have I leraned?

Data and sense of control.

I was very surprised to hear that all our participants were victims of scams and don’t feel like they can trust companies.

It gave me even more of a sense of purpose in the work I do, and made me feel like I’m genuinely helping people. These conversations with participants still remain as guidance in my day to day of product conversations and decision I make.

Communication.

Communicating research findings to internal and external stakeholders with value and recommendations. Distilling information received and turning it into next steps and course of action.

Method.

The type/quality of information that can be extracted from interviews vs quantitative.

I'm not always right (*Gasp*)

Acknowledging my own mistakes and assumptions - writing a list of assumptions and comparing it to our final findings was very eye opening and humbling. It made me realise my strenghts when it comes to my view on product and also humbled me when I was certain about something being correct.

The power of a team

I learned a lot from watching Zee and Jean - the way they communicate, previous knowledge they had about research, etc. I learned from Zee about pre-research planning and new tools. From Jean I learned a lot about prototyping and UI tricks in Figma.